Legal Action Facts

Who We Are

Navient has supported the investment students make in college by helping them navigate a complex federal student loan program created by Congress. Despite a maze of obstacles for borrowers that badly needs reform, we have led the way by increasing enrollment in affordable payment plans and helping millions of Americans successfully pay off their student loans. From 2009 through 2021, Navient provided student loan servicing for the U.S. Department of Education, and we are proud of the work we accomplished for borrowers.

Navient by the numbers:

During our time as a servicer for the Department of Education:

- More than 400,000 borrowers paid off their student loans every year1

- Navient borrowers were 34% less likely to default2

- More than half of Navient-serviced federal loan volume was enrolled in Income-Driven Repayment plans.

As of fall 2021, Navient no longer services loans for the Department of Education

THE ROLE OF SERVICERS FOR U.S. DEPARTMENT OF EDUCATION-OWNED LOANS

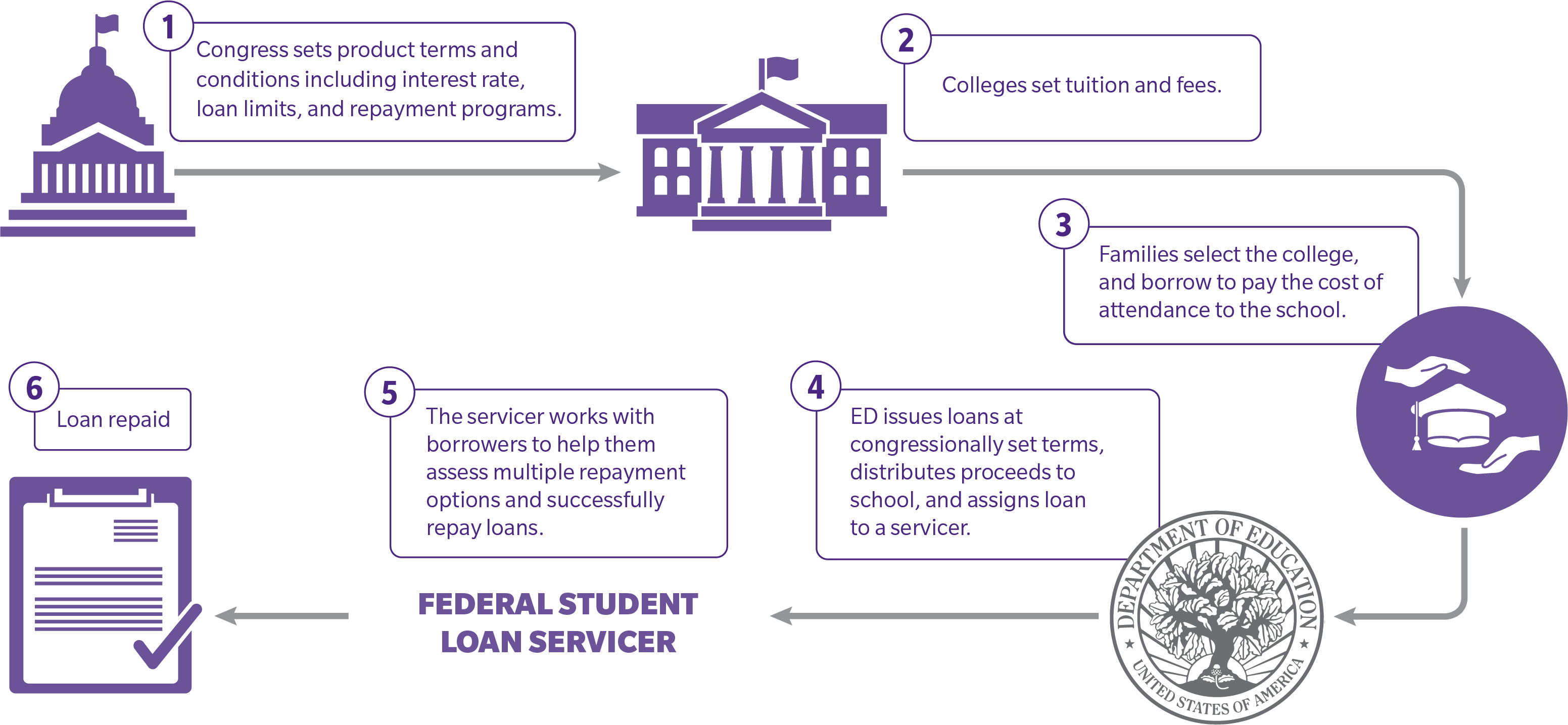

Servicers of federal student loans, including Department of Education-owned loans, do not set loan terms like interest rates, loan limits, and repayment programs. Instead, they are established by the federal government. Servicers begin working with student borrowers after many important decisions have been made, such as the amount to borrow or which college to attend.

WHAT TO KNOW ABOUT LAWSUITS INVOLVING NAVIENT

Beginning in January 2017, the Consumer Financial Protection Bureau (CFPB) and six state attorneys general filed lawsuits against Navient asserting a variety of allegations.

NAVIENT’S AGREEMENT WITH STATE ATTORNEYS GENERAL

On January 13, 2022, Navient announced agreements with state attorneys general to resolve all previously disclosed multistate litigation and investigations. While these allegations are false and baseless and we strongly believe we would prevail in court, we decided to resolve these matters to avoid the continued burden, expense, and distraction of state litigation.

News Release: Navient Announces Successful Resolution of Legal Matters with State Attorneys General

Frequently Asked Questions: Navient Resolution of Legal Matters with State Attorneys General

FACTS ABOUT THE CFPB LAWSUIT

Filed in January 2017, the CFPB’s lawsuit against Navient continues and contains nearly identical claims as those made by the state attorneys general.

The suit’s primary allegation is that, during Navient’s time servicing Department of Education-owned loans, Navient “steered” borrowers away from income-driven repayment (IDR) plans toward forbearance. This and other allegations raised are false. The litigation continues, and the company will continue to fight these baseless allegations in court.

On May 19, 2020, Navient filed a Motion for Summary Judgment in the CFPB lawsuit, seeking to dismiss the case in its entirety.

Here are the facts:

- During its time as a servicer for Department of Education-owned student loans, Navient was a national leader in enrolling borrowers into Income-Driven Repayment (IDR) plans. More than half of the Department of Education loans Navient serviced were enrolled in IDR programs – more than any comparable servicer. Furthermore, servicers are paid up to 60% less for loans in forbearance, so there was no economic interest in Navient placing a borrower in forbearance instead of an IDR plan.

- Navient provided clear and easily understood notices to borrowers about IDR plans and their renewals

- Navient accurately processed tens of millions of borrowers’ payments every year.

Navient will continue to vigorously defend itself against the CFPB’s baseless claims with the facts and our strong performance and support of our borrowers’ success during our time as a servicer of Department of Education-owned student loans.